SIEM System Protection for Your Financial Institution

Photo Credit: everythingpossible © 123RF.com

Photo Credit: everythingpossible © 123RF.com

|

In today’s technology environment, financial institutions are consistently searching for ways to secure their network. However, many institutions do not take full advantage of monitoring tools that may enhance their security and safeguard their network. For these institutions, a Security Information and Event Management (“SIEM”) system may provide the additional protection needed. |

Flood Coverage – Still a Hot Regulatory Issue

Photo Credit: Galina Peshkova

Photo Credit: Galina Peshkova

|

Flood certifications, coverage, insurance, and placement – these are common in any financial institution’s compliance vocabulary nowadays. It’s no secret that all regulatory agencies have had “flood” as a hot topic for the past few review cycles. Financial institutions have been reinforcing their knowledge and awareness of the issue. Yet, even with all of the training that banks and credit unions have paid for and had their employees attend, why are financial institutions still receiving flood violations? Read Full |

Interagency Statement on Sharing BSA Resources and Challenges

Photo Credit: semisatch

Photo Credit: semisatch

|

On October 3, 2018, an Interagency Statement was issued by five agencies/regulatory bodies to provide banks with an option to enter into a collaborative arrangement involving two or more banks to share their available resources in order to ensure compliance with Bank Secrecy Act/Anti-Money Laundering (“BSA/AML”) requirements... |

Improving Cybersecurity Governance

Photo Credit: iStock

Photo Credit: iStock

|

The risk landscape for financial institutions is constantly changing with a myriad of new regulations and growing cybersecurity threats. In this environment, surveys continue to show that Boards of Directors and Senior Management lack confidence in their institution's cybersecurity capabilities and that cybersecurity governance is often inadequate... |

New Jersey's Corporate Business Tax Legislation: A Look at the Impact for Banks

Photo Credit: Stuart Miles

Photo Credit: Stuart Miles

|

This past weekend, the New Jersey Legislature and Governor Murphy came to an agreement on Corporate Business Tax ("CBT") changes in connection with the State's 2019 fiscal year budget... Read Full |

Enhancing Data Protection

Photo Credit: Marina Putilova

Photo Credit: Marina Putilova

|

With the advent of new regulations, such as NYDFS Part 500 Cybersecurity Requirements and General Data Protection Regulations ("GDPR"), more focus has been placed on securing data in transit and data at rest... |

Correspondent Banking: The Challenges of Data Transparency

Photo Credit: stocksnapper

Photo Credit: stocksnapper

|

As institutions continue to face challenging regulatory regimes and examinations, there are certain takeaways that banks, especially domestic branches of foreign banking organizations (“FBOs”), can benefit from, and adapt to, as a result... Read Full |

Regulation E and Business Account Errors

Photo Credit: olegdudko

Photo Credit: olegdudko

|

I was asked this week, how and when does Regulation E apply to business customers if they report a claim? My answer: it doesn’t, but it could... Read Full |

A Lesson in Equifax

Photo Credit: J.R. Bale

Photo Credit: J.R. Bale

|

At this point, we have all heard about the Equifax breach that has affected approximately 143 million U.S. consumers along with certain citizens in the UK and Canada... |

Controls over Employee and Officer T&E Expenses

Photo Credit: Galina Peshkova

Photo Credit: Galina Peshkova

|

Over the past year, we have seen the regulators more closely scrutinizing banks’ expenditures as they relate to Officer’s Travel and Entertainment (“T&E”). Depending upon the nature of the bank’s business, asset size, and officer structure, controls in this area might vary greatly. However, one thing for sure is that we are moving towards the fact that institutions should have an adequate process in place to address their specific risks... Read Full |

Is Regulation CC Put on the Back Burner?

Photo Credit: prykhodov

Photo Credit: prykhodov

|

Regulation CC was enacted in 1987 in order to standardize hold periods on deposits made to banks and to regulate a bank’s use of deposit holds. There have been many changes throughout the years, but one in particular is that all checks are considered local and clear on a much timelier basis than in earlier years. One thing that remains unchanged is Regulation CC applies to both personal customers and commercial customers... Read Full |

Training – An Investment and Risk Management Tool

Photo Credit: Mikko Lemola

Photo Credit: Mikko Lemola

|

Throughout my entire career in the banking industry, I have been a strong – actually make that an obnoxious – advocate for employee education and training. As a C-level executive at several institutions, I have both encouraged and required staff to seek out any and all seminars, conferences, schools and vendor programs... Read Full |

Are You Gambling with Your BSA Program?

Photo Credit: Vitaliy Kytayko

Photo Credit: Vitaliy Kytayko

|

It’s that time of the year again for your BSA/AML compliance audit. We know how much you enjoy it when your BSA internal auditors show up with smiles as big and long as their request memos and sample sizes – from policies to procedures... Read Full |

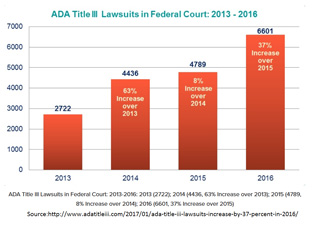

ADA Website Compliance: For Whom the Bell Trolls

Photo Credit: http://www.adatitleiii.com

Photo Credit: http://www.adatitleiii.com

|

Over the last year or so, banks have been heavily focused on complying with the latest cybersecurity laws and regulations -- as they should be -- but lately, it has been a much older law that has been causing compliance and financial stress... |

The Case of Foreign Banks and Heightened Scrutiny

Photo Credit: Kheng Ho Toh

Photo Credit: Kheng Ho Toh

|

There is what appears to be a trend happening in the foreign branch banking market that seems all too consistent. That trend is the influx of MRAs, MOUs, and Consent Orders being handed down by the federal regulators for having insufficient BSA/AML and OFAC compliance programs. Read Full |

IRS and New Jersey Tax Audits of Banks

Photo Credit: Val Goretsky

Photo Credit: Val Goretsky

|

Budget deficits and other fiscal concerns combined with challenging economic conditions continue to place pressure on federal and state governments to generate increased revenue through tax collections... Read Full |

State Taxation of Financial Institutions in Today's Environment

Photo Credit: Megan Shull

Photo Credit: Megan Shull

|

Among the most challenging areas of taxation confronting banks today are the state tax ramifications resulting from the institution's business activities. With the prevalence of Internet-based activities, expansion of services offered by banks and extended geographic reach, the evaluation of state tax implications is much more complicated and requires greater analysis. |

Does your 401(k) Plan need an Audit?

Photo Credit: adiruch

Photo Credit: adiruch

|

The July 31st reporting deadline for employee benefit plan Form 5500s will be upon us in the blink of an eye; it’s important for banks to be familiar with the 401(k) audit compliance rules before it’s time to file. |

De-Risking of Foreign Correspondent Banks

Photo Credit: Michael Borgers

Photo Credit: Michael Borgers

|

On October 5, 2016, the Office of Comptroller of Currency (“OCC”) issued guidance relative to foreign financial institutions de-risking policies with respect to maintaining foreign correspondent banking relationships. Read Full |

Same Day ACH Credits – Phase One

Photo Credit: Daniil Peshkov

Photo Credit: Daniil Peshkov

|

In today’s environment, we want everything faster, especially when it comes to our finances. National Automated Clearing House Association (“NACHA”) has adopted a new rule that will enable same-day processing for ACH credits received by the Receiving Depository Financial Institution (“RDFI”). Read Full |

NYDFS considers requiring CISOs for all NY Financial Institutions

Photo Credit: Leo Wolfert

Photo Credit: Leo Wolfert

|

Last fall, the New York Department of Financial Services (“NYDFS”) released a statement regarding potential new regulations aimed at increasing cybersecurity defenses at financial institutions. Fast forward to one year later and the NYDFS ups its game once again. In September 2016, the NYDFS proposed new cybersecurity requirements to protect New York State Financial Institutions and consumers, a “first-in-the-nation regulation"... |

FinCEN Finalizes Ruling on Beneficial Ownership and Ongoing Customer Due Diligence

Photo Credit: Scandinavian Stock

Photo Credit: Scandinavian Stock

|

As the saying goes, the chickens have finally come to roost. FinCEN and the banking authorities have issued a final ruling on beneficial ownership with respect to Customer Due Diligence, now requiring financial institutions to identify beneficial owners of covered businesses as part of the account opening process. Read Full |

Keep an Eye On Your Chip!

Photo Credit: alicephoto

Photo Credit: alicephoto

|

By now, a lot of credit card and debit card companies in the U.S. have begun to issue cards with the new “chip” technology. Here’s a little background on the chip card technology and its unfolding in the U.S... Read Full |

Is the IRS Status of your Defined Benefit plan in Jeopardy?

Photo Credit: lightwise

Photo Credit: lightwise

|

Electronic certification (“e-certification”) for loans and hardship withdrawals, without the retention of appropriate supporting documentation, is considered a QUALIFICATION FAILURE. Read Full |

The Dilemma of Banking Medical Marijuana Businesses and Other Indirect Risks

Photo Credit: David Carillet

Photo Credit: David Carillet

|

We’ve all come to the realization that the legalization of marijuana in the U.S. is something that is becoming more and more prevalent. As state legislatures and lawmakers have since softened their policies on marijuana usage (medicinal or recreational) and begun to see the monetary benefits of legalizing such at the state level, there still presents a heightened risk of money laundering in the banking industry. Read Full |

OnCourse Staff

OnCourse Staff

The OnCourse writing staff work to keep you informed about the most pertinent financial industry news of the moment

OnCourse Staff's Posts